Automate Invoice Processing - Eliminate Manual Data Entry

We design custom AI-powered systems to automate invoice processing from capture to payment - extracting data, validating information, routing for approval, and syncing with your accounting system - cutting processing costs by up to 80% while your team focuses on strategic financial work.

The Invoice Processing Challenge

Your accounting team spends hours every week manually entering data from invoices – typing vendor names, amounts, line items, and account codes into your system. They chase down approvals, catch errors too late, and struggle to keep up with monthly close deadlines. Meanwhile, vendors complain about late payments, and you’re paying skilled employees to do work that AI should handle. If you’re ready to automate invoice processing, here’s why businesses choose custom-built solutions over generic software.

Manual invoice processing doesn’t just waste time – it scales linearly with volume. According to research from the Institute of Finance & Management, the average cost to process an invoice manually ranges from $6-$15, while automated processing reduces this to $2-$5. If you’re looking to automate invoice processing, you’re not alone – 75% of AP teams are implementing automation in 2025. More invoices mean more headcount, higher costs, and more opportunities for costly errors.

Pain Points:

- 10-20 hours per week lost to manual data entry – Industry studies show that over 56% of finance teams spend more than 10 hours per week on invoice processing instead of strategic financial work

- Invoice approval bottlenecks delay payments – Invoices sit in email inboxes waiting for approval, damaging vendor relationships and missing early payment discounts

- Data entry errors cause reconciliation nightmares – Manual typing leads to mismatched amounts, incorrect GL codes, and duplicate payments that take hours to track down

- Zero visibility into invoice status – You can’t answer “Has this been received? Approved? Paid?” without digging through emails and spreadsheets

- Processing costs scale with volume – Every 1,000 additional invoices requires another full-time employee at $6-$15 per invoice in processing costs

- Multiple invoice formats create chaos – Paper invoices, email attachments, PDFs, and vendor portals all require different manual handling processes

Custom Automation Built for Your Invoice Workflow

The best way to automate invoice processing is with a custom system built for your specific workflow. We design and implement intelligent invoice processing systems tailored to your approval rules, accounting codes, and vendor relationships. Using FlowRunner and AI agents, we build automation that captures invoices from any source – email, uploads, or direct vendor submissions – then automatically extracts data, validates against purchase orders, routes for approval based on your business rules, and posts to your accounting system.

This isn’t configurable software that forces your process into templates. We analyze your current workflow, interview your accounting team, and build a custom solution that handles your specific vendor mix, approval thresholds, exception handling rules, and integration requirements. Every business has different approval hierarchies and coding requirements – we build automation that matches how you actually work.

What We Build For You:

AI-Powered Data Extraction

Automatically pulls vendor name, invoice number, date, amount, line items, tax, and GL codes from any invoice format – PDFs, scanned images, emails, or paper documents. The AI learns your vendor naming conventions and improves accuracy over time.

Smart Validation & Matching

Matches invoices against purchase orders, checks for duplicates, flags amount discrepancies, and validates GL codes against your chart of accounts. True 3-way matching compares PO, invoice, and receiving documents to catch errors before payment.

Custom Approval Routing

Routes invoices based on your criteria – amount thresholds, department budgets, vendor types, GL codes, or complex multi-level hierarchies. Automatic escalation when approvals are delayed, with a full audit trail of who approved what and when. Learn how we automate appointment scheduling with similar approval workflows.

Accounting System Integration

Direct sync with QuickBooks, NetSuite, Xero, SAP, or your custom ERP. Invoices post automatically after approval with correct GL codes, cost centers, and vendor details. No manual export/import or duplicate entry.

Exception Handling Workflows

Clear processes for PO mismatches, missing information, invoices requiring special review, or amounts outside approval thresholds. Exceptions route to the right person with context about why manual review is needed. See how we handle exceptions in customer support automation

How We Automate Invoice Processing From Inbox to Accounting System

We follow a proven methodology to automate invoice processing without disrupting your current operations. Here’s how we transform your invoice workflow:

Step 1: Analyze Your Current Process

We map your complete invoice workflow – from how invoices arrive to how they’re approved and posted. We document your approval hierarchies, GL code structure, vendor relationships, PO matching requirements, and exception handling rules. This discovery phase ensures we understand your business-specific requirements before building anything.

Step 2: Design the Automation

We define exactly how the system will work: data extraction rules for your invoice formats, validation logic against your business rules, approval routing based on your thresholds and hierarchies, and integration mappings to your accounting system. Your accounting team reviews and approves the design before we start building.

Step 3: Build & Test

Using FlowRunner, we build your custom invoice processing system with AI trained on your actual invoice formats. We integrate directly with your accounting system and test with real invoices from your top vendors. We validate accuracy, handle edge cases, and ensure the system works with your specific vendor mix before going live.

Step 4: Deploy & Train

We launch the system with your team, train them on exception handling and system monitoring, and provide documentation for ongoing use. We monitor processing accuracy during the first weeks, continuously improve the AI’s data extraction based on corrections, and optimize workflows based on real-world patterns.

Results When You Automate Invoice Processing

Measurable Outcomes:

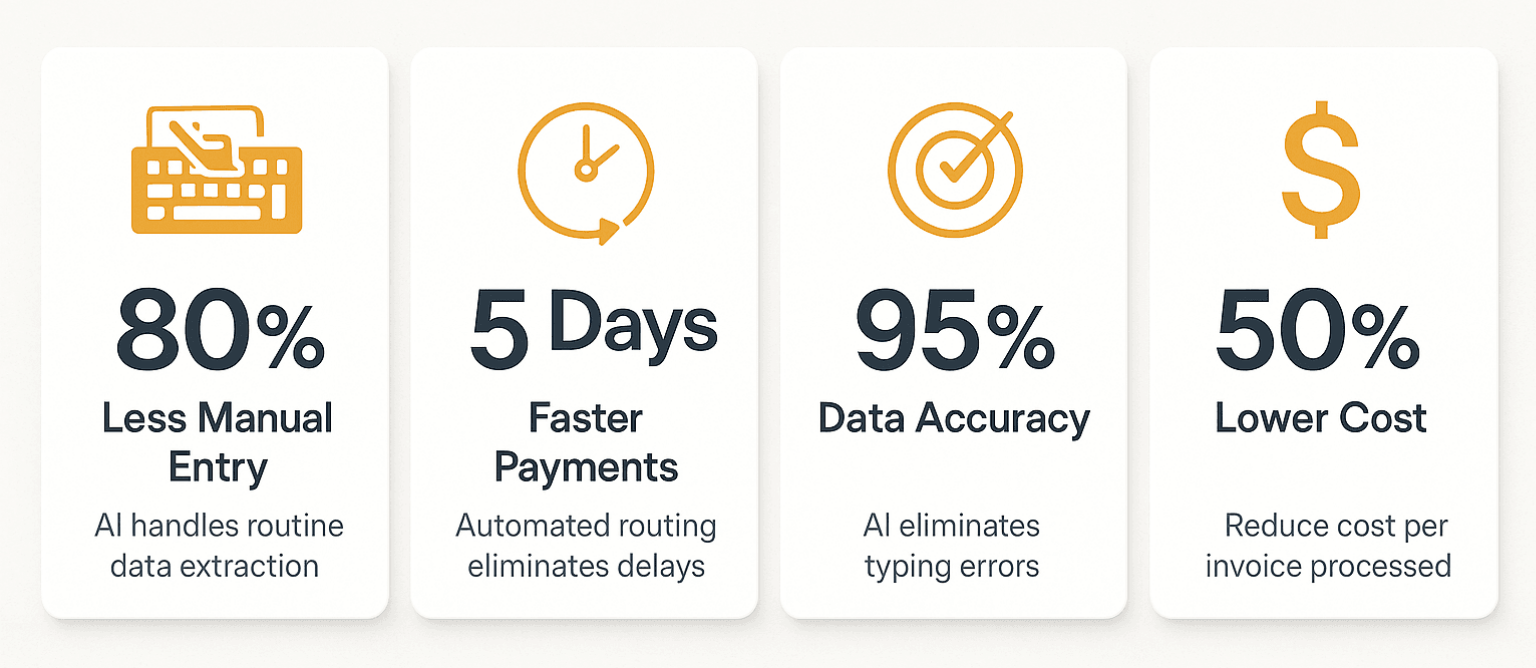

80% reduction in manual data entry – AI handles routine invoice data extraction automatically, freeing your accounting team from repetitive typing to focus on strategic financial analysis and month-end close activities.

3-5 days faster payment cycles – Automated approval routing eliminates the bottlenecks of invoices sitting in email inboxes. Your vendors get paid on time, you capture early payment discounts, and you strengthen supplier relationships.

95%+ data accuracy – AI extraction eliminates human typing errors in vendor names, amounts, and GL codes. The system flags discrepancies for review before posting, preventing costly reconciliation headaches and duplicate payments.

50% lower processing costs – Reduce your cost per invoice from $6-$15 down to $2-$5 by automating manual work. Scale your invoice volume without proportional headcount increases as your business grows.

Complete audit trail – Every invoice, approval, and accounting system posting is tracked and timestamped. Answer “who approved this and when?” instantly, with full compliance documentation for audits and financial reviews.

Zero invoices fall through the cracks – Automated capture ensures every invoice is received, tracked, and processed. No more missed invoices, forgotten approvals, or vendors calling about late payments.

Why Choose Midnight Flow

When you’re ready to automate invoice processing, you have two options: buy generic software or work with an agency that builds custom solutions. We don’t sell generic invoice processing software. We’re a strategic AI automation agency that designs and implements custom invoice processing systems on FlowRunner – built specifically for your approval rules, accounting structure, and vendor relationships.

Our Differentiators:

AI That Learns Your Invoices

We train AI agents on your specific invoice formats, vendor naming conventions, and GL code structure – so data extraction accuracy improves over time as the system learns from corrections. Unlike generic OCR software that struggles with non-standard formats, our AI adapts to your unique vendor mix and invoice variations.

True 3-Way Matching

Our systems can match invoices to purchase orders and receiving documents, flagging discrepancies and routing exceptions based on your business rules – not just simple data capture. We handle complex validation scenarios like partial shipments, price adjustments, and quantity variances that generic software can’t accommodate.

Flexible Approval Workflows

We build approval routing that matches your actual process – whether it’s based on amount thresholds, department budgets, vendor types, GL codes, or complex multi-level hierarchies. No forcing your business into rigid software templates. If your approval process changes, we modify the workflow to match.

Built on FlowRunner

Every automation runs on FlowRunner, the platform we control. That means we can handle any invoice format, integrate with any accounting system (including custom ERPs), and modify workflows as your business changes – without vendor dependencies or expensive customization fees from third-party platforms.

Strategic Implementation Partnership

We don’t just hand you software and walk away. We analyze your process, design the optimal workflow, build and test with your actual invoices, train your team, and continuously optimize based on real-world performance. You get a dedicated implementation partner, not a support ticket system.